A portfolio with diversification?

G.R. Krahmer

What is a portfolio, and what is meant by diversification?

If you are looking for information about investing, you will likely come across the words “portfolio” and “diversification”, but what does this actually mean? To properly understand diversification, it is first important to know what a portfolio is, so…

What is a portfolio?

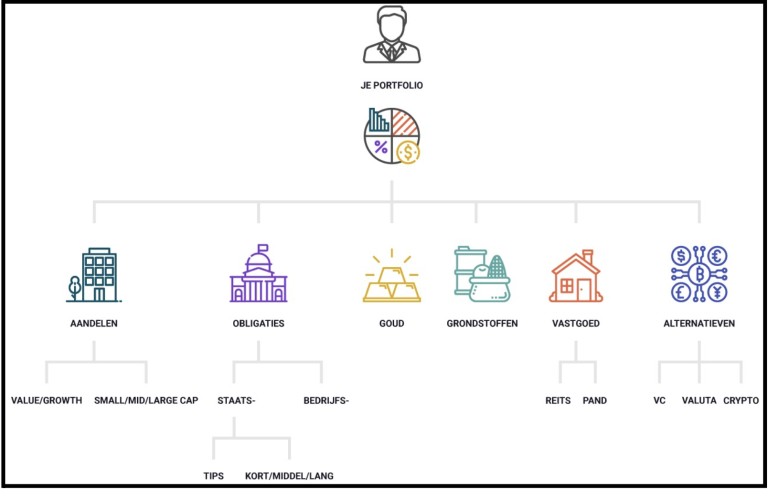

A portfolio or portfolio is nothing but a collection of investments. In some cases, this may be a share you own, your accrued pension and a house you have invested in. All these investments together are called your portfolio, which you can clearly see in figure 1.

Figure 1: Different investments within a portfolio.

What is spread?

Distribution is actually nothing more than the different proportions between categories in your portfolio. Diversification is, simply put, a way of describing the fact that you include multiple types of investments in your portfolio.

Why should I spread?

For example: One of the biggest investments most people make in their lives is buying a house. Unfortunately, a house is only one building, which is also fixed at a specific location. You can say that this is risky, because this house can drop in value if, for example, your roof collapses, the neighborhood deteriorates, or if a highway is built right next to your house. This means there is a chance that you will be left with less than that you expected.

“The best way to deal with this is not to worry too much, but to spread it with confidence.”

Why wouldn’t my asset allocation just be 100% equities?

Supplementing your portfolio with more asset classes than just stocks can make your approach much stronger, but does that make sense?

I mean, the historical returns for an all-stock portfolio speak for themselves, and are pretty compelling too. In the past, shares have achieved higher returns than, for example, bonds over the long term. This would mean that bonds are defensive assets that reduce volatility, but they do not necessarily mean that you achieve higher returns. On top of that, interest rates are so low these days that bonds don’t look attractive at all.

That is why people often say:

“If you can ride out the bad years and invest as much money as possible in stocks, you’ll be better off, and ultimately have a bigger pile of money when you retire.”

But is that so?…

If you are the type of investor with: a steady income, few financial obligations, an iron stomach that can withstand heavy blows from the market in the short and long term without touching your investments, then a Total Stock Market Portfolio be an excellent investment.

But since you’re reading a piece about diversification in your portfolio, I assume you’re looking for multiple perspectives. You have come to the right place for this, because we think that the power of diversification can offer a great solution to greatly reduce risk, without sacrificing a lot of return. A portfolio with stocks, bonds and multiple asset classes can therefore be more reliable and efficient for most investors.

How do you apply distribution?

You see that we distinguish between different categories to invest in. In our case, we use index funds and ETFs, because they allow you to include multiple categories in your portfolio in an easy and accessible way.

Because the index is almost never beaten over the long term. We try to, in our case, choose an index fund or ETF that (cheaply) reflects a complete investment category as much as possible. This way you can achieve an average return for a specific category. And you also run less risk.