Many people think that buying a house is always a better option. Perhaps the most

common argument is that if you rent a house you are “throwing away” your money. But

aren’t you throwing money away when you buy a house?

In this article I analyze the costs of both buying and renting a house, including a

number of examples. Of course there are more reasons to decide to buy or rent, it

may be that you attach great importance to the feeling of having your own place or

you value the idea that you can live somewhere else at any time if you wish. would

like.

Emotional reasons can also be a good reason to substantiate your choice. For

example, I also spend more money on food when I go out to eat because I get a

pleasant experience and get away from home for a while. I would have more money

for that. But then I would like to know in advance approximately how much this will

cost and not be surprised afterwards with a bill that is many times higher than I

expected. That is what I want to achieve in this article, but with the purchase of a

house.

How much exactly do you pay when you buy or rent a home?

Often only the monthly costs are taken into account, it is then compared whether the

monthly costs of the mortgage are higher or lower than the costs of rent. If this is

cheaper, then the conclusion is quickly that buying is a better option. This way of

comparing is skewed and poses some problems.

Let’s start with the most common argument, that you are throwing your money away

when renting.

This is partly true. Yes, it is true that the house does not become your property, but

you can live in it. So you throw away the money just as much as you do with a

television or internet subscription. At the end of this subscription you will not

suddenly become the owner of the internet.

To avoid comparing apples and oranges, we break down the costs in this article

recoverable costs and non-recoverable costs and we compare the total

non-recoverable costs of rents, and compare that against the total non-recoverable

costs of buying.

With non-recoverable costs is meant the money you lost without being there assets

gets in return. The rent of your house is an example of this, but the interest on the

mortgage also falls under non-refundable costs. When you pay off your mortgage,

you get the ownership of your home in return. These are the recoverable costs.

This amount is easy to calculate for a rental property. Your monthly rental amount is

usually equal to the non-refundable costs of your home and you may or may not

include municipal taxes, etc., depending on what makes a better comparison with an

owner-occupied home in your municipality. This is more complicated with an

owner-occupied home.

The monthly costs that you pay for the mortgage are made up of a part that you pay

off to the bank. For this part you get back ownership of the house. You pay off the

loan you took out to become the owner of the house. But it also includes some

interest. In addition, there are taxes that are not included in the normal rental and

mortgage comparisons. As a homeowner, you are also responsible for the

maintenance of the house.

Occasionally we will have to make assumptions, because public information is not

available on everything or because this varies greatly per person. Later in this article

there is a calculation tool in which you can change the values yourself. If you do not

agree with the way the values have been chosen for certain costs, you are free to put

your own spin on it. It is especially important that you can make a complete and fair

comparison for yourself, because this choice can literally make tens of thousands of

euros of difference over a longer period.

Mortgage interest

How much do you really pay for your home if you buy it with a mortgage?

In the Netherlands, the average interest rate on a mortgage is currently around 2%.

This value changes regularly and has certainly been a whole percent higher in recent

times.

This sounds like a small percentage, but over the entire term of the mortgage the

amount can be high. The amount depends on the type of mortgage you have chosen.

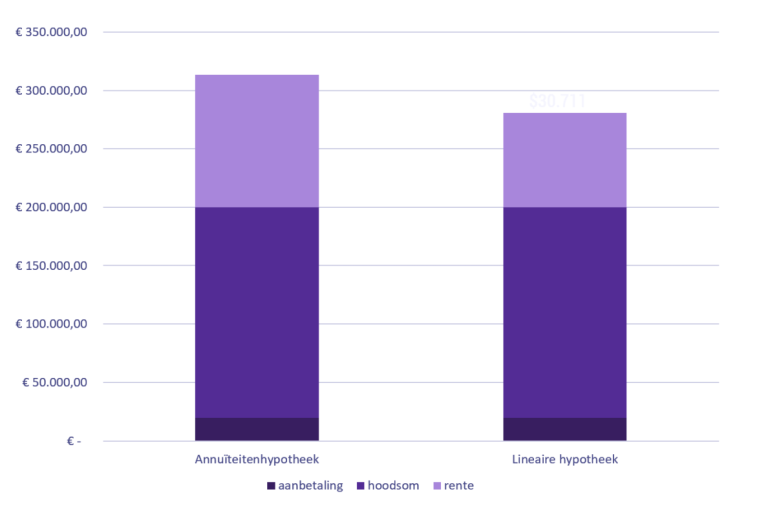

In this article I will briefly discuss two types of mortgages, first of all the most

recommended mortgage, the annuity mortgage, and the classic linear mortgage.

The annuity mortgage is popular because the amount remains the same over the

months. This has the advantage that it is cheaper at the beginning, but it also means

that you pay a larger percentage of interest at the beginning and repay a smaller

percentage. This means that the amount you pay monthly interest on decreases very

slowly, meaning you end up paying much more over a longer period. With a linear

mortgage, your repayment amount remains the same. This means you pay off more

at the beginning, which means the amount you pay interest on also drops faster. This

is more expensive at the beginning and is therefore not often chosen, but at the end

you are better off. They say this is not true, but a simple calculation shows that it is

not true. I will link to an article about it here soon.

As you can see, you pay almost 1.5 times the price of your house on the mortgage.

Even low percentages can have a serious impact in the long term, and the banks

know this. This principle is better covered in our article on the power of

compounding.

Maintenance costs

To maintain the value of your home, you occasionally have to carry out maintenance

on your home. With a rental property this is included, but with an owner-occupied

home it is up to you as the owner to maintain this. This ranges from minor

adjustments to renovating your entire bathroom or kitchen. To choose a number that

we can calculate with, I estimate these annual costs at 1% of the value of the home.

Taxes

There are different municipal taxes per municipality. Most of these are regulated in

the municipal law

(https://wetten.overheid.nl/BWBR0005416/2020-01-01#TitelIV_HoofdstukXV).

The costs of this and even the different types of taxes can vary greatly per

municipality. Examples of this are sewerage charges, precariobelasting, water

system tax, environmental management or in the case of a 2

and home capital gains

tax. If these costs do not apply to the rental property in that municipality, you must

enter these costs as additional costs. In this article I do not include this as a

difference in non-refundable costs.

Insurance

Purchase costs

When purchasing a home there are a number of major upfront costs. For example,

you can make a down payment to lower your interest rate, but you also have:

- transfer tax (2% of the purchase price)

- notary costs

- brokerage fees

- appraisal costs

- construction inspection

- National Mortgage Guarantee Costs

- Advice & mediation costs

Most mortgage providers estimate these costs between 6% and 7% of the purchase

price.

https://www.hypotheker.nl/begrippenlijst/veelgestelde-vragen/hoeveel-eigen-geld-hy

potheek/

Opportunity cost

Since this site is aimed at investors and the majority of readers will also invest, I

cannot ignore the so-called “Opportunity cost”.

Opportunity cost compares how much return you have missed by no longer having

this amount in liquid form.

This amount is of course largely the purchase costs, but in addition you make

monthly repayments on your mortgage, which gives you more ownership of your

home. This is a real estate investment. You could also have invested this investment

elsewhere. Like, for example, on the stock market. Globally, the stock market

achieved a return of 5.2% after deduction of inflation between 1900 and 2017, while

in the housing market you would have received 1.3% in return.

Increase in value of your home

In general, the value of your home increases over time. This is also a reason for

many people to buy a house and something that cannot be left out of this equation.

https://www.cbs.nl/nl-nl/visualisaties/huizenmarkt-in-beeld

https://www.cbs.nl/nl-nl/nieuws/2020/07/huizenprijzen-in-de-meeste-gemeenten-op

nieuw-gestegen

On average, house prices have risen by 1.3% per year over the past 100+ years. For

many, an important argument for purchasing a house.

In the Netherlands, however, it is the case that the profit you make based on the

value of your house when you sell your house must be used to invest in the mortgage

of your next house. So if you buy a house again, this amount is not freely available

and if the housing market is currently high, this is an advantage when selling, but just

as much of a disadvantage when purchasing your next home.

Since paying off the mortgage is a recoverable cost, as you get a home in return, we

cannot include this in the calculation. We only compare the non-refundable costs. If

you were to rent, you also have the option to invest the amount that you would

otherwise repay. There is a good chance that you will achieve a better return on this

while you can also maintain more diversification.

The calculation

We can approximate the average annual non-refundable costs of your home for an

owner-occupied home by the following calculation:

(Purchase costs × opportunity cost) + mortgage interest + maintenance costs + taxes - insurance.

For a home with a value of €200,000 and the percentages approximated in this

article, we arrive at an annual amount of:

(€200.000,- × 7% × 4%) + (€200.000,- × 3%) + (€200.000,- × 1%) + (€200.000,- × 1%) =

€10.800,-.

Which amounts to €900,- non-recoverable costs per month. This is then constructed

as follows.

[picture from ppt – economy ]

We have added a calculation tool here so that you can enter the values that you feel

comfortable with.

[ Calculation tool ]

Inflation

The comparison is actually not yet complete. It became too complicated for the

calculation tool, but if you rent, your rent will still increase with inflation, which is not

the case with an owner-occupied home, where the total amount is more or less

known in advance. This is difficult to estimate, because only the extremes are

demarcated and can be found in this article central government.

https://www.rijksoverheid.nl/onderwerpen/huurverhoging/vraag-en-antwoord/wat-isde-maximale-huurverhoging-in-2019#:~:text=direct%20naar%20inhoud-,Wat%20is%2

0de%20maximale%20huurverhoging%20in%202019%3F,geldt%20alleen%20voor%20

sociale%2Dhuurwoningen.

If you choose to rent, keep a close eye on it before it turns into a potential silent killer.

Fortunately, this builds up slowly and you have every opportunity to do something

about it in the meantime.

Right

As a tenant you also have rights such as tenant protection or allowances. Depending

on your own personal situation, this will make a big or small difference in the

comparison between renting or buying. If you’re curious, check it out for yourself

rights and obligations as a tenant.

https://nl.hellolaw.com/wonen/woning-huren/rechten-plichten-huurder

Particularly on low incomes, allowances can be a huge factor in the choice between

renting or buying. Maybe a nice topic for a next article? Let us know in the comments

below.

Emotional value

So far we have looked at it purely from a financial point of view, but that is of course

not the whole story. Your home is the place where you live, it is important that you

enjoy yourself there. If you do not have the motivation to make a rental home

beautiful or if you simply like the feeling that the home is your own, then that of

course also plays a role in the decision. Sometimes larger interests can also play a

role, for example if you want to leave your house to your children.

In the other direction, the security of, for example, rental protection or the freedom to

move whenever you want, regardless of the state of the buyer’s market, can weigh

heavily for some.

What I focused on in this article is whether it is a good choice for you financially to

rent or buy. Now that you have an overview of the differences in prices, you can

decide for yourself how much value you attach to it.

Conclusion

There are far too many factors that ensure that you cannot simply compare the

monthly mortgage payment against the costs of the rent and draw a conclusion

based on that. There are many costs that are not immediately noticed by everyone at

first glance. If I find new angles myself, I will add them to this article, because I too

may have missed something. Do your own research before making a decision about

this.

The difference between Acc and Dist ETFs

Why leverage is much less bad for your portfolio

Graham Stephan – Which is Cheaper: BUYING or RENTING a house? (DEBUNKED)

Ben Felix – Renting vs. Buying a Home: The 5% Rule

https://www.youtube.com/watch?v=UuAZ4M9f_sM

Counterarguments – you have the feeling that the house is yours and that you can

really decorate something the way you want without asking people for permission

Do it yourself, increase the value of your home / invest

https://www.snsbank.nl/particulier/hypotheken/kopen-of-huren.html?s_kwcid=AL!61

57!3!328547372552!e!!g!!huis%20kopen%20of%20huren&gclid=CjwKCAjw0_T4BRBlE

iwAwoEiAZmOCFQHh8GrD1mYx-WA5_nShQfKDhqO8XZjbDuwLOQKBvfGkf1t7hoCW

GIQAvD_BwE

Buying a home

Advantages

You can completely adapt the house to your own wishes.

If interest rates do not change, mortgage costs are usually stable.

You build up capital by making repayments.

Disadvantages

You can move less easily.

Housing costs can change if interest rates rise or fall. These changes are not always

clear in advance.

You must maintain your home yourself.

You must pay additional insurance and taxes: home insurance and levies from the

municipality and water board.

Your house may decrease in value. This means you may be left with a debt when you

sell it.

https://www.nibud.nl/consumenten/woning-kopen-huren/

[l1]Check