G.R. Krahmer

What is the MSCI?

The MSCI index is a benchmark/measure of the stock market in a specific area. Most people

are familiar with the AEX or the Amsterdam Exchange Index. The AEX is an index that consists

of the 25 largest and most traded listed companies in the Netherlands on the Euronext

Amsterdam. The AEX keeps track of the top 25 companies from the Netherlands, and the S&P

500 index keeps track of the top 500 companies from the U.S.A. bee. In the same way, the

MSCI tracks the performance of all shares included in this MSCI index.

How can you use the MSCI?

MSCI Indices are used as the basis for Exchange Traded Funds (and Index Funds). The ETF

duplicates the holdings of this MSCI index and in this way, by buying that ETF, investors can

benefit from an increase in the index. For example, the MSCI Europe Index tracks all

medium-sized and large companies from 15 European countries. That’s a total of 429

companies. If you search among brokers for an ETF for this purpose, you will come across them

with names like “iShares Core MSCI Europe UCITS ETF”.

If you invest in an MSCI Europe Index through such an ETF, you invest in ALL 429 companies

that are included in that index.

Depending on the index you choose, you can purchase thousands of companies at once with

one investment, providing you with a broad diversification.

In the same way, these MSCI indexes are also used as benchmarks by active fund investors. An

ETF usually simply follows such an MSCI Index, while active fund investors try to outperform

their MSCI Index benchmark by choosing better shares.

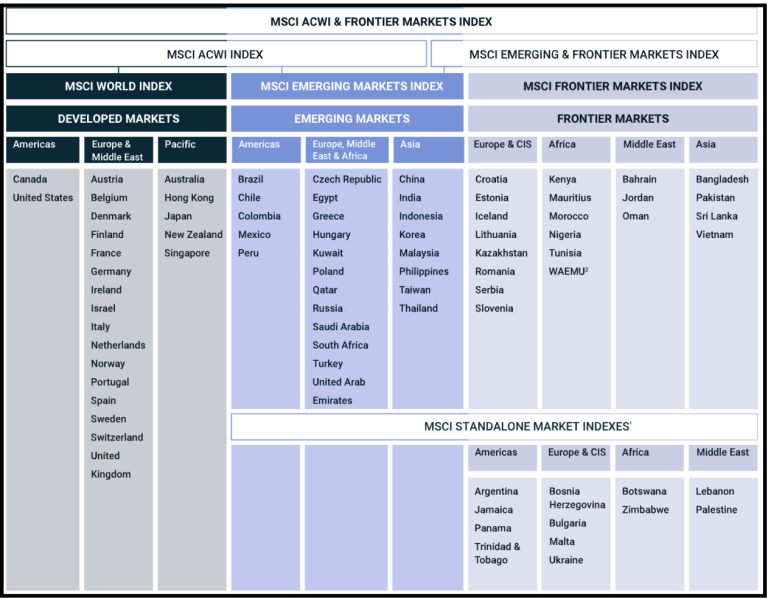

MSCI has an index for all kinds of groups. From a global index that includes developed and

emerging countries such as the MSCI ACWI, or only specific share categories such as

small-cap, mid-cap or large-cap (Stocks with a large market capitalization are labeled as “large

caps”, those with an average market capitalization as “mid-caps” and those with a small market

capitalization as “small caps”.).

There are indexes for entire continents such as Asia or Europe or for a specific country such as

Greece or China. There are even indexes where a continent is taken and one particular country

from that continent is left out such as the “MSCI Europe ex Switzerland UCITS ETF“So you

can invest very specifically and put together an investment portfolio that is tailored to your

wishes. The most popular indexes, also the ones with the widest spread, are the Emerging

Markets, Frontier Markets, Developed Markets, the All Country World Index, or the All Country

World Index IMI. We will go into this in more detail below.

MSCI World Index

The MSCI World Index tracks large and mid-cap companies located worldwide. This index is

often used by the media in the financial world to describe how the global stock market is

performing. The MSCI World Index is generally viewed as the benchmark of the global stock

market. It is true that this index excludes companies from emerging countries (!), so this index

should be seen as an index of global developed countries. The MSCI World Index includes

stocks from the following 23 developed countries:

Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland,

Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden,

Switzerland, United Kingdom and the United States.

MSCI Emerging Market Index

The MSCI Emerging Market Index tracks large- and mid-cap companies based in emerging

countries. This index tracks stock market performance in the following 26 emerging countries:

Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India,

Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi

Arabia, South Africa, Taiwan, Thailand , Turkey, United Emirates. Kuwait will be included in this

from November 2020.

This index is often used as a benchmark for the performance of the emerging countries.

MSCI All Country World Index

The MSCI ACWI, MSCI’s flagship global equity index, is designed to track the performance of

large and mid-cap companies from a total of 23 developed countries and 25 emerging countries.

This index contains more than 2900 companies in 11 different sectors.

MSCI ACWI Investible Market Index (IMI): The MSCI ACWI IMI tracks approximately 9,000

different stocks from large-, mid-, and small-cap segments from 49 developed and emerging

countries. This index, which IMI supports, was created to include all the different variations of

market caps, sectors, and combinations between them. The difference between the ACWI and

the ACWI IMI is that the ACWI IMI also invests in small-cap companies in addition to the large

and mid-cap portion.

MSCI Frontier Markets Index

The Frontier Markets Index tracks the stock market of countries that can be very risky. This

index was also only created in 2007. This index tracks the performance of the stock market in

the following countries: Bahrain, Bangladesh, Croatia, Estonia, Jordan, Kazakhstan, Kenya,

Lebanon, Latvia, Mauritius, Morocco, Nigeria, Oman, Romania, Serbia, Slovenia, Sri Lanka,

Tunisia and Vietnam.

The Frontier Markets also include the MSCI WAEMU countries such as: Benin, Burkina Faso,

Guinea-Bissau, Ivory Coast, Mali, Niger, Senegal and Togo.

These markets could yield a lot of profit because they have a lot of room to grow. The biggest

risk is that this index is not widely traded. This can make them difficult to sell if the economy

deteriorates and easier to tamper with by hedge funds. These countries may be more

vulnerable to changes in trade, political systems or other economic problems.

Conclusion

MSCI is one of the best benchmarks for a well-balanced investment strategy. As one of

the building blocks of such a balanced investment strategy, investors can choose the

variation of the MSCI that best suits the equity portion of their portfolio. You can use an

ETF or index fund based on the MSCI Index to invest in countries that you prefer. Some

people prefer to choose a stock market that is closer to home, such as an MSCI Europe

Index. Other people prefer a global spread and choose an MSCI All Country World Index.

With an MSCI ACWI ETF you invest with transactions in more than 2900 companies in

almost 50 countries. Personally, I have no preference for countries or continents, and

have therefore opted for a worldwide distribution.