Article Greg: Your finances under control: Get a grip on your money, get a grip on your life!

Your Finances Under Control:

Get a grip on your money, get a grip on your life! G.R. Krahmer | 25-10-2024

A

Many people dream of a million euros, believing that this will solve all their problems.

Even millionaires can face financial problems. The key to a healthy financial life does

not lie in a fortune, but in discipline, good planning and awareness.

The importance of discipline. Just like with good intentions, discipline is super

important in achieving your financial goals. It’s more than just a good plan; it is actually

taking action. Consistency and focus are the reason for success.

Draw up a financial plan. The basis of a healthy financial life is a clear plan. This plan

helps you manage your money, achieve your goals and protect you against unexpected

expenses.

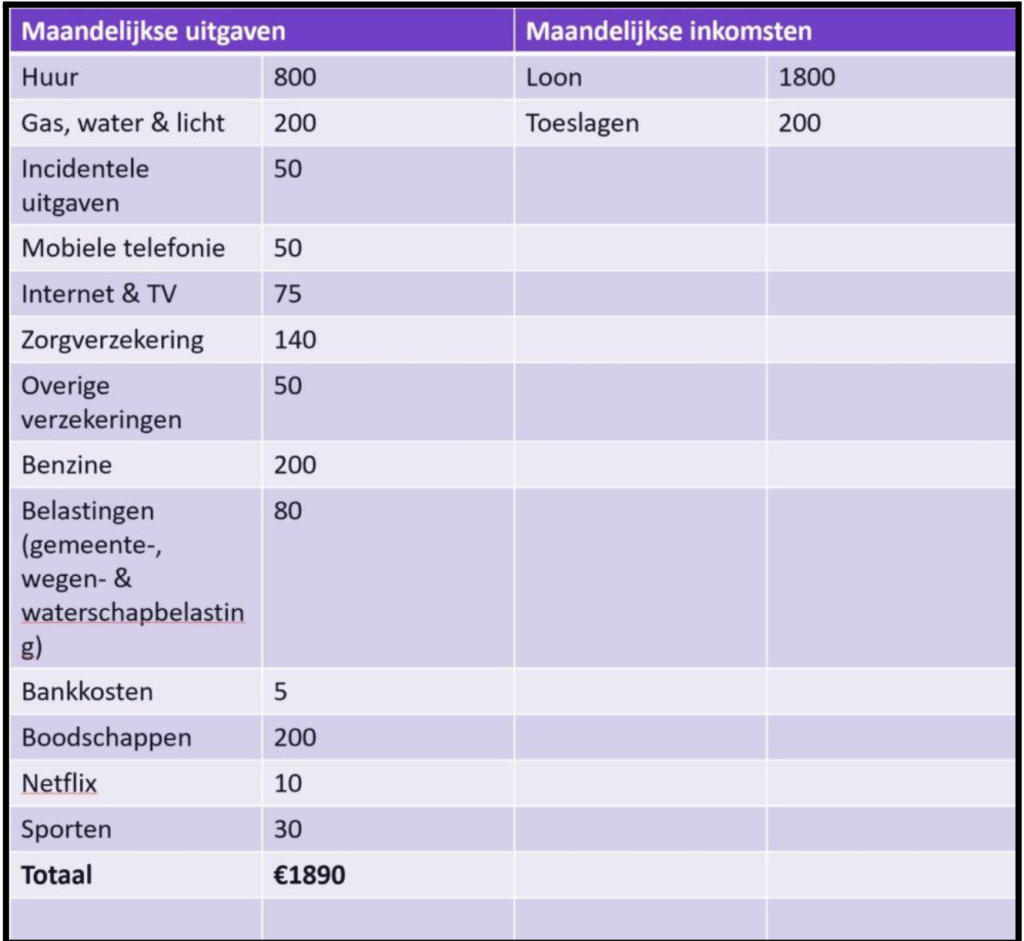

The first step. Start by mapping your income and expenses. Take the time to analyze

everything, from fixed costs to spontaneous purchases. Take a critical look at your

expenses and ask yourself: “Do I really need this?” That’s how I found out what I had

left to invest.

Budgeting. Then you draw up a budget. Determine how much you want to spend per

month on different categories, such as housing, food, transportation, and

entertainment. Stay within your budget and track your progress. Also plan for the

future. Make sure you get started on your pension. Also take the time to invest.

No commercial ever!

I want you to go to the upper right of your screen. Right next to the star on the right of your URL. The puzzle piece, press it with your mouse, and then click extensions. Search for “AdBlock – block free commercials on YouTube and your favorite websites” and click install it. Now put the extension on and you’re ready to go!

How I watch and save almost everything.

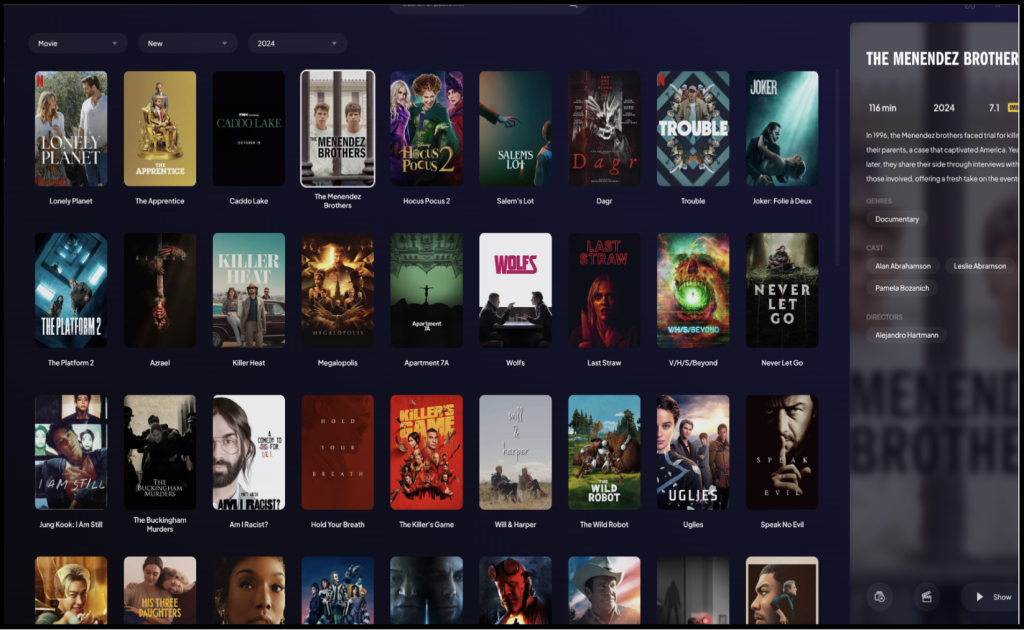

Netflix, Amazon Prime, Disney+ and more… I don’t use any of the newest movie’s and series, since I use https://www.stremio.com/downloads. After downloading Stremio, you just have to install a couple of extensions. Now you’re set to watch movies and series, old and new. Literally everything is on there, just check it out. You can get for Windows, macOS, iOS, Google Play Store and many more. Then if you’re going somewhere without internet, then just download it and your sets of movies and series. Just so that people don’t have 7 different streaming services. For which they, of course, pay.

Stremio

Budget apps and cashback.

Woolsocks and Dyme

I personally use These apps help you map and categorize your

expenses, see your expenses, and help you see the subscriptions that you are paying

too much for. Not to mention, you get cashback or a better deal on a lot of things.

helps you map out the subscriptions and you can save a lot.

Woolsocks

is from the

same inventors as DEGIRO. No wonder things are going so well, if you ask me. 😉

Dyme

Dyme

Dyme is about the same, but with a different perspective. They are looking more to how much did you pay for this subscription? And how much is a reasonable price? So, you got money from your old subscriptions, which was already good. Plus, they go out and fix the next insurance you’re going to pay. That’s why they call them geeks because, they find better contracts or insurance. This year I saved €578.85, and as the Scrooge I am (hehe), I will look for further financial opportunities.

Woolsocks

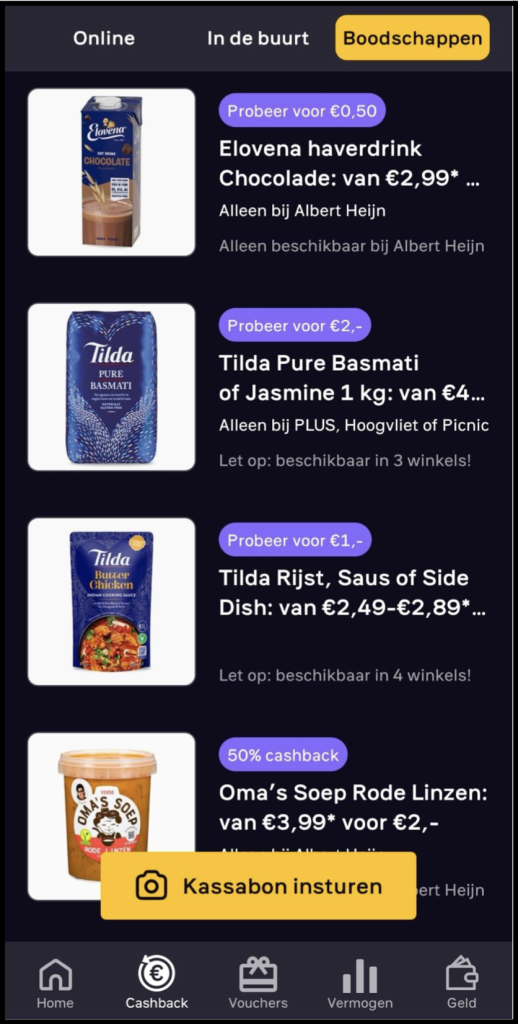

It’s often €0.50, €1 or €2, but a lot of times things are free. Are you missing out on valuable cashback and free rewards from your everyday purchases? Woolsocks is your one-stop-shop for earning cashback, free items, and exclusive rewards from a wide range of stores, including supermarkets but also Amazon, Bol.com, Steam, and Twitch. All you have to do is scan your receipts, select the items you want to be rewarded for, and you’re good to go. But here’s the best part – if you connect your bank account, you can set up auto-rewards, making the process even more seamless.

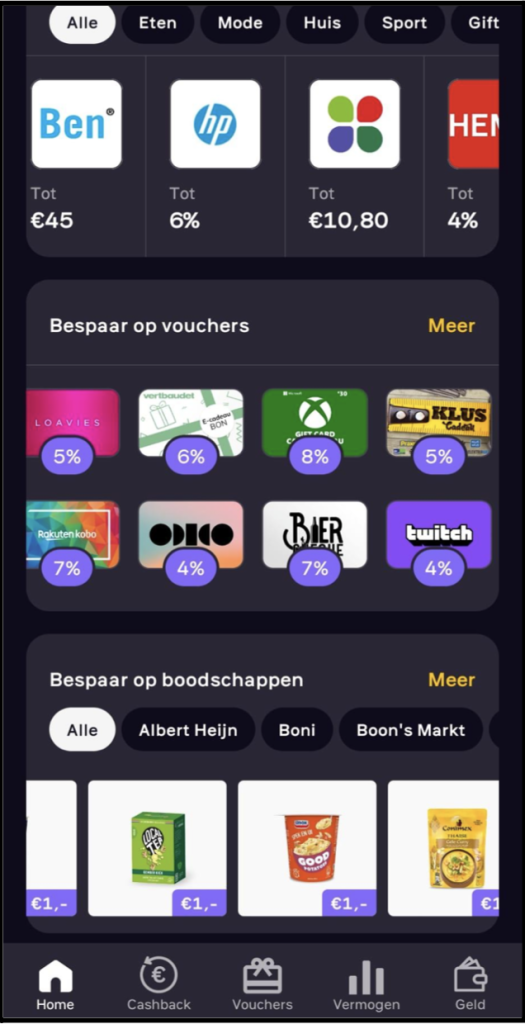

You can earn a variety of rewards, from Woolsocks gift cards to ODIDO, HP, and more. It’s like getting free money just for doing your regular shopping. Imagine being able to spin a cartwheel, which is actually the case, and potentially walking away with 20 cents in Stockpoints, or even gift cards worth €10 or €25. After a while, your Cashback sock, will need to get emptied because, after a while, it gets full of microtransactions. As you can see, I have about €60 payout, and €66.60 to wait for. The good thing is that there is a possibility, in Woolsocks, to put your money in an Index Fund or ETF directly.

Final word

Only invest money you can afford to lose and know that investing involves risks. Always do your own research. This will make investing a valuable addition to your financial planning. You can choose to pay out in money, or you can put your money in stocks. I decided to buy an All-World FTSE every month at Woolsocks. Since costs are pretty low and, it’s possible to do that. I thought why not.

Remember: “A healthy financial life is not a sprint, it is a marathon. It requires discipline, consistency and a long-term vision.”

By becoming aware of your spending, creating a plan and changing your mindset, you will be on your way to a stable and stress-free financial future. So, whether you’re a savvy shopper or someone who’s just looking to save a few extra bucks. Dyme & Woolsocks are the apps you need to have.