By G.R. Krahmer

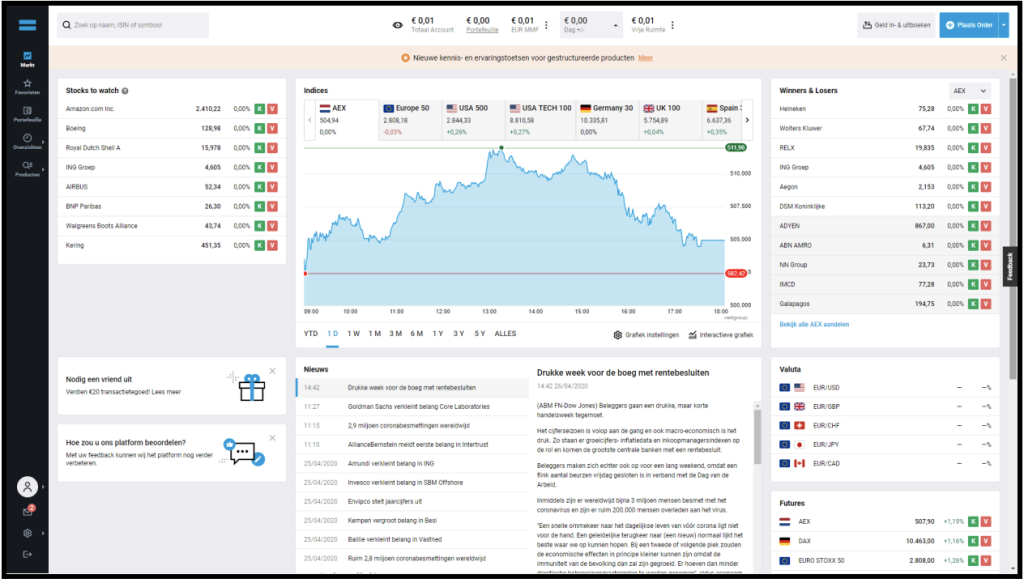

First you log in to your DEGIRO account and the screen will look like this:

If all goes well, you have transferred an amount to your DEGIRO account number, otherwise

you can do this by pressing the gray button at the top right and deposit money via iDEAL (or

another method). This amount will be credited to your free space, and you can continue to the

next step. At the top left, you can click in the search box, and then you can search for a number

of products. Here, you can search for exactly what you want to invest in. Suppose you want to

look for an ETF that tracks the MSCI World Index. Then you enter MSCI world, for example, in

that box. You will often receive a list of suggestions that are very similar, as you can see below.

FIRE GREG: Degiro

Very confusing for a novice investor. If you want to know the difference between these ETFs and therefore want to learn which one suits you best, we have it here an article on how to decipher these names.

iShares Core MSCI World UCITS ETF is a fund that tracks the MSCI World Index, so if you want to buy it, press the green one with a K, or the “buy” button. You can see this in the image below.

Fortunately, placing orders is the same for all three accounts, so I only have to explain it once.

If you click on it, you will have the option to place a number of different types of orders.

How do you place your first order?

In general, you can choose from a number of different orders. Below, we will briefly explain what exactly this order means and how you can execute it. In our case we actually only use 2 types of orders, but because we do not all implement the same strategy, I will cover them all

Different order types

If you want to purchase an ETF, you have 4 different order types at DEGIRO. We actually only use market order and limit orders. The other two orders are slightly more complex, and in any case we have never used them before.

Market order

When you place this order, you indicate how many pieces you want to buy or sell. The order is

filled with the quantity of pieces that are offered at that moment. It is then executed at the

available price that is offered at that time (with a purchase order) or requested (with a sell

order). If you want to place an order for, for example, 1 ETF with a unit price of € 32, it will be

executed at the best price found for this.

Limit order

The difference is that with a limit order, you also indicate the price for which you want to buy or

sell an ETF, for example. The big advantage of this type of order is that this order is only

(automatically) executed when the indicated price of the ETF reaches your indicated limit. The

order is only executed when there is a counterparty that wants to take the other side of the trade

at a price that is higher (for a sell order) or lower (for a buy order).

Order duration

FIRE GREG: Degiro

A daily order is open until it is executed or until the stock market closes at the end of the day. If the order has not been executed on that day, it will be automatically removed at the end of the trading day.

Standing order

A standing order will continue to the next day when the stock market is open. If the order has not been executed by the end of the current trading day. The way in which standing orders are handled depends on the relevant exchanges.

I have one below as an example market order placed from 1 piece of the “iShares Core MSCI World UCITS ETF USD (Acc)”. You will then always receive additional control where you can see which order you have placed, but also the estimated costs involved. If you have checked your order, and you want to execute it, you can press the ‘confirm’ button and your order will be placed. Now all you have to do is wait for it to run.

It can sometimes take a while before the transaction is actually executed. At the ‘orders’ or

‘transactions’ you can see the current status of your orders/transactions. Once your order has

been executed you can go to “wallet” see how your investments are doing.