By G.R. Krahmer | 05-02-2022

If there is one thing that investors have lost a lot of money in, it is chasing profits, especially when that one star of a fund manager comes along. Occasionally, a rock star fund manager comes along who turns the entire market upside down and manages to beat the indexes with high returns.

Cathie Wood an Ark Invest

Cathie Wood an Ark Invest

Catherine D. Wood, founder of Ark Investment Management LLC. She became famous for betting that Tesla would be worth a billion dollars in 2018, while the company was on the brink of bankruptcy. Tesla currently has a market cap of $825 billion. Wood's focus is on innovative technologies in many exciting markets such as Robotics, Fintech and Autonomous Technology. As a result, investors poured their hard-earned money into Cathy Wood's fund as quickly as possible, only to see her assets under management balloon from $45 million in 2014 to $50 billion today. This immediately makes investors drool, and you hear more and more often: Hmm... why would you settle for 10%, while with ARKK you can get 150%?

Sinking ship

Things went less well for the well-known fund manager in 2021. The funds in which she invested fell further into the red. The asset manager's flagship, the ARK Innovation ETF, is about a quarter lower at the end of 2021 than at the start of the year. All of Cathie Wood's ARK funds have fallen sharply since May 2021. That is why I expect that the average ARK investor has achieved disappointing results since the start of her fund in 2014.

This is not Cathie Wood's fault, but has more to do with our human nature.

Because of greed and F.O.M.O., we want to buy the things that have skyrocketed and sell the things that have collapsed without considering the long term. This is based on the principle “reversion to the mean” which in short means that funds that have performed well over a period of time will only very rarely continue to do so in the near future.

“Paying a low price for a reasonable company is better for expected returns than paying a high price for the best company out there.”

Buy low, Sell high

We love to chase profits. We like to buy high. Likewise, we then tell ourselves stories about why these investments will continue to increase. And we cling to every bit of hope/rationalization of our investment choices.

Most people bought in at a high point after the funds had a good run. And then they dropped considerably. The average investor in Cathy Wood's five funds has returned just 5.24% per year since they were set up. That's quite strange, considering that the first four funds have achieved an average annual return of 39.77% for ARKW, 25.87% for ARKG, 33.97% for ARKK and 25.87% for ARKQ since September 2014. The final and fifth fund has delivered an average annual return of 55.28% since inception in February 2019. (Returns taken from the ARK website)

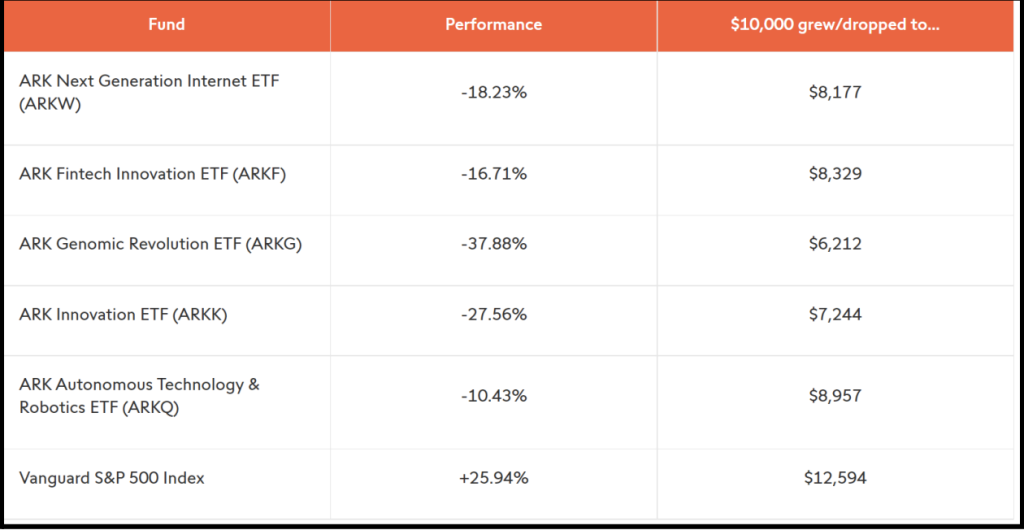

These days, few people talk about Cathy Wood. Since February 2020, the best ARK fund is (ARK Genomic Revolution ETF) fell by a hefty 37.88% until the end of December 2021. None of its funds have posted gains since February, even though the S&P 500 is up 26% in the same time.

Conclusion

Choosing funds by looking at past returns is a big mistake. It’s like being stuck in a traffic jam. If the lane next to you seems to be going faster, it is tempting to change lanes. But as soon as you change lanes, you come to a standstill, while the lane you just came from starts to move on. Cathie Wood’s example is just one of many.

There is a reason why it is always mentioned in investments that returns achieved in the past do not guarantee the future. That’s because most investors lose money this way. Of course, no one knows how Cathie Wood and her innovative strategies will fare in the long run, but history isn’t in her favor either way.

Of course, you can make big profits by choosing the best performing fund managers. It is just virtually impossible to choose these in advance, just like with choosing the winning stocks. The best chance of a good return in the long term therefore seems to be once again buying a cheap, broadly diversified index funds.

“From a 2009 study by Fama and French: Luck vs skill – https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1356021

It emerges that the vast majority of fund managers do not have enough skills to deliver the expected returns based on the risk they take. The research seems to argue that successful fund managers have more luck than anything else. Besides the fact that they are mainly lucky, there is something else that plays a role in their underperformance.

If a fund manager has achieved good returns for a long time, more and more money from investors flows to these managers. This capital becomes so large that investors can no longer benefit from these skills because the fund achieves lower returns due to scale. The larger the fund becomes, the greater the competition and the more difficult it becomes for the fund manager to beat a passive benchmark, after fees.

You see throughout history that these fund manager superstars come and go. And investors who invest in these funds, who have achieved significant results in the short term, usually suffer large losses in the long term. Including copying profitable Day Traders, and strategies from other fund managers”