What is the best way to invest in crypto?

G.R. Krahmer

We invest in crypto with the following philosophy:

If the crypto market is going to boom then you want to own a little bit, and if the crypto market collapses then you want to own a little bit.

In both cases, we want to have a little bit of exposure to the crypto market. We see investing in crypto as a way of alternative investing. We believe in the value of the blockchain because it certainly has potential. In addition, we see that many people invest in crypto as a way of building wealth. But which crypto coins should you buy, and which should you not? And where is the best place to invest in crypto?

Previously, I had in an article about the dotcom bubble found a number of similarities. My expectation is that cryptocurrency will face the same fate as the dotcom bubble. If that is the case, the following will happen:

“A handful of crypto will survive and provide almost all the returns in the long term.”

What would be a strategy that would have been profitable during the dot-com bubble?

The easiest, but hardest to emulate, was simply having invested in the winners. After all, if you had invested heavily in Amazon.com, you would have had a nice return. During the Dotcom bubble, Amazon entered the market with a starting price of $18 per share. It rose to just above $100 per share at the peak of the bubble, before falling below $6 in a very short time. An Amazon.com share is currently worth $3,090, so if you had chosen that as the winner, you would now be in the right place.

So, how do I buy Bitcoin?

So that’s the whole point. If the same rules apply to investing in crypto as to normal index investing, then it is better not to try to pick the winners and losers. It may be a new technology, but it remains human behavior, and that remains unpredictable. So since stock picking is not my thing for the reasons I explained earlier, the chance that I will choose the right cryptos seems very small to me. Almost as likely as the odds of me winning the lottery, and I don’t even buy lottery tickets. Then I’d rather buy the entire lottery. So, for example, by only investing in Bitcoin, the chance is too great for me that it will underperform the average return of the crypto market.

Investing Index in Cryptocurrency

If I had invested in the S&P500 or the Nasdaq by dollar cost averaging from the top of the tech bubble until now, I would have had a nice average return of almost 8% per year. Give me a high chance of a good return rather than a small chance of a super return. If there is one thing I have learned from investing, it is that index investing is the best way to build wealth for almost

everyone. And by following the index, you automatically invest in the winners. It is easy, much cheaper, and all research shows that passive index investing works out 90 to 95% better in the long term than an active strategy. This way you can easily grow your assets passively without having to worry about it. And simplicity pays off.

The search for the best crypto index to invest in crypto

Firstly, I want a good diversification, so in addition to cryptos, it is wise to hold multiple asset classes. In addition, I want to leave I use multiple cryptos at the same time, and I don’t feel like doing research on all kinds of individual crypto coins. As we always advocate for index funds, this principle also applies when buying crypto. Buying a broadly diversified index fund, or ETF, gives the vast majority of people the best chance of a good return.

The Digital Currency Index

Cryptocurrency ETF’s and indices are currently being offered in more and more places. If I then look at the holdings of, for example, “ETH etc – ETC Group Physical Ethereum” then it only follows Ethereum. I don’t really understand the point of that, since you could just as easily buy Ethereum on an exchange. Most crypto ETFs that are for sale at most brokers today often contain only a handful of cryptos. There were a few with about 4 or 5, but there was no Bitcoin or Ethereum among them. Then you will soon buy 3 ETFs for 7 crypto coins. It seems a bit too little spread to me. You can of course also build it yourself, but if you have to place 50 orders every time, it will take a lot of time, let alone if you have to rebalance. Fortunately, there are now a number of ETFs and indices. So below is a list of ISIN codes with investment fund costs so you can easily search for them.

BitPanda Bitcoin ETC

Bitpanda Crypto Index 5

Bitpanda Crypto Index 10 Bitpanda Crypto Index 25 CoinShares Physical Bitcoin CoinShares Physical Ethereum Iconic Funds Physical Bitcoin ETP Iconic Physical Ethereum ETP VanEck Vectors Bitcoin ETN VanEck Vectors Ethereum ETN WisdomTree Bitcoin

WisdomTree Crypto Altcoins

WisdomTree Crypto Market

WisdomTree Crypto Mega Cap Equal Weight WisdomTree Ethereum

What conditions must the index meet?

DE000A3GVJ41 BCI5

BCI10

BCI25 GB00BLD4ZL17 GB00BLD4ZM24 DE000A3GK2N1 DE000A3GTML1 DE000A28M8D0 DE000A3GPSP7 GB00BJYDH287 GB00BMTP1519 GB00BMTP1626 GB00BMTP1733 GB00BJYDH394

The index tracker I am looking for must at least meet a number of conditions. First, it must be a physical tracker and not a synthetic one. So physically backed. Secondly, I want to purchase the actual coins and not a basket of companies that work with the blockchain. Just as I do not specifically invest in Gold Miner ETFs, but I do invest in a Physical Gold ETF, I want the same

with the digital currency. It has to be a passively managed fund because I don’t want people speculating with my money. I want to start with a small amount and periodically deposit a fixed amount at the lowest possible cost. Liquidity is also important to me, so that I always have the opportunity to access my money quickly. Finally, I want it to be a market-weighted index that tracks as much of the cryptocurrency market as possible.

Where is the best place to invest in crypto?

Depending on the strategy you follow, different brokers can play a different role.

There are many different ways to invest in cryptos, but since we maintain a pro-index investing strategy, we also want this when investing in crypto. If we assume that we want to invest passively in a cryptocurrency index, we look for a broker or party that meets the conditions. Unfortunately, most crypto ETFs that are currently for sale at most brokers often contain only a handful of cryptos, and with many funds, you have to start with a large amount.

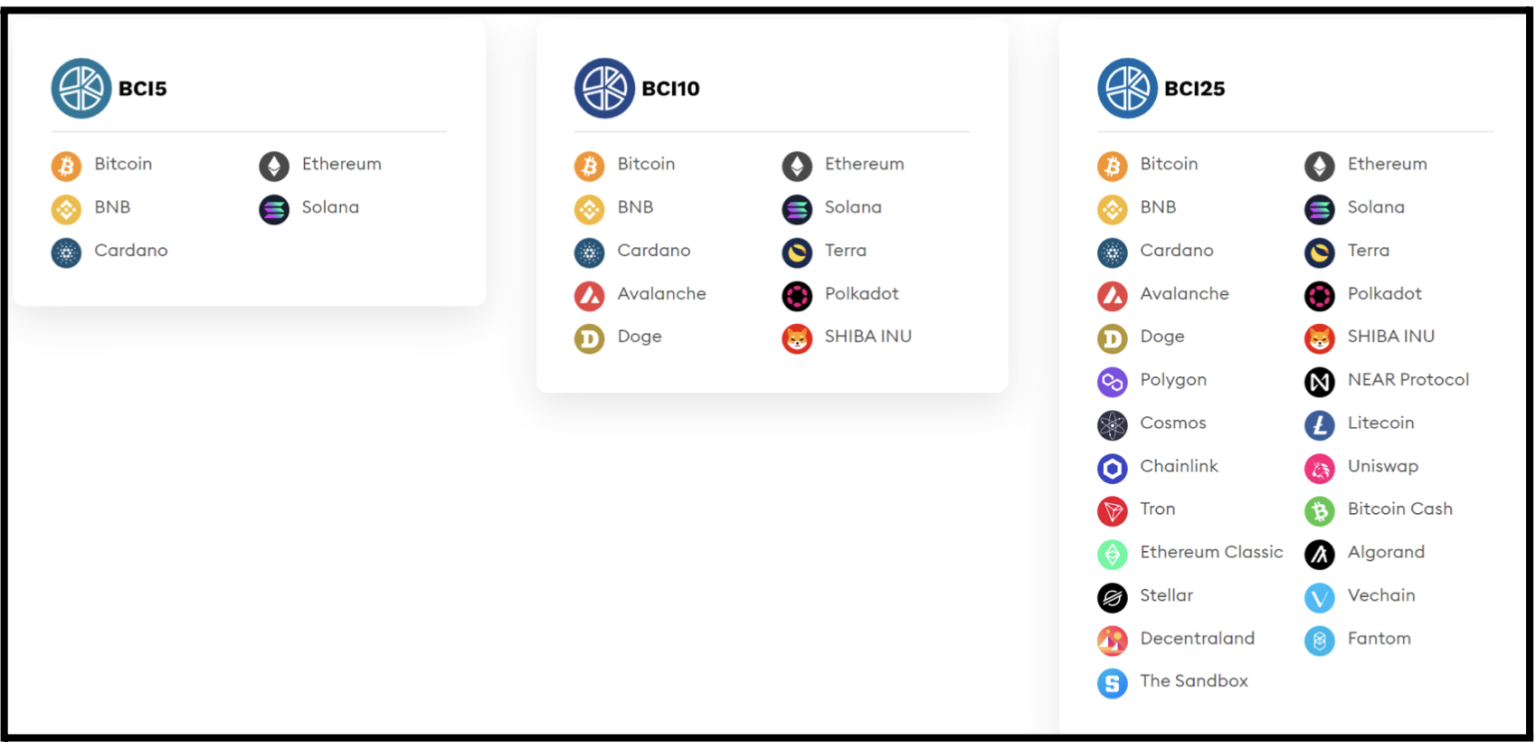

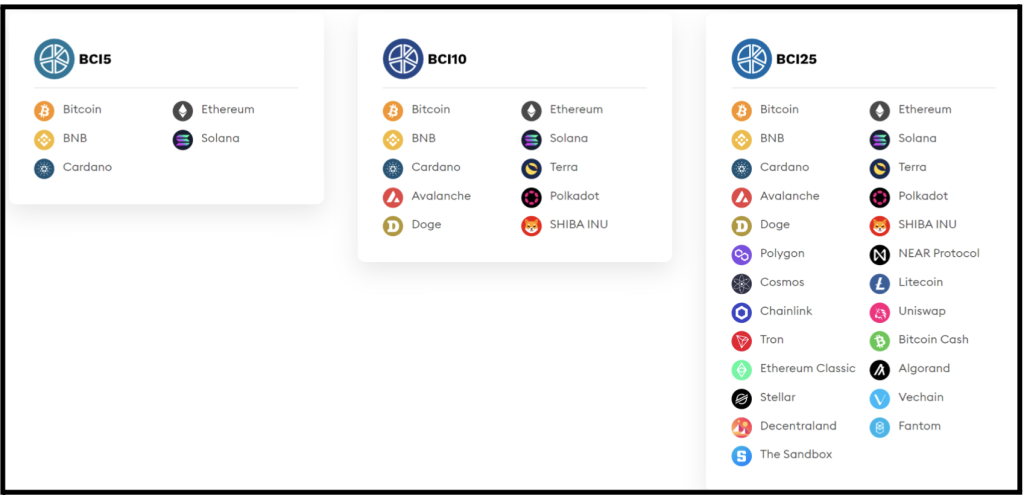

Bitpanda currently offers 3 different indices. The BCI5 invests in the top 5 cryptocurrencies in terms of market size and volume. The BCI10 invests in the top 10, and the BCI25 invests in the top 25. Personally, I think the spread is important, and I think the top 5 or top 10 are just a little too little. For that reason, I chose the BCI25. With this index, I immediately place myself in the top 25 cryptocurrencies based on market size and liquidity with 1 transaction. The handy thing about Bitpanda is that you can also make small manual adjustments. For example, if you think there are a few other cryptos missing, you can add them to your portfolio.

By dollar cost averages or periodically adding a fixed amount to this index, you don’t have to worry about the timing, either. The index automatically adjusts the weighting of your portfolio over time. This way you get nice average returns from the top 25 cryptocurrencies of the crypto market without having to worry much about it.

For me, this is really the most efficient way to benefit from the (possible) future returns of the digital currency. If you look at the past and what happened during the Dotcom years, I think there are a handful of cryptos that will shape the future. Whether that will result in a profit remains to be seen.

The Benefits

Creating an account is free and very easy. You can reach Bitpanda, not just for digital currencies. You can buy individual shares there, but also precious metals such as gold, silver, palladium, and platinum. They offer a fairly small range of global shares, trackers, and bond ETFs. So, as a long-term investor with a simple ETF portfolio and a little bit of crypto index, this can be quite a good platform. You can also earn a quick €5 by taking a quiz.

You can set up a savings plan that actually gives you all the choices you need. The minimum amount for this savings plan is €25; you can choose to deposit it every week, every month, or twice a week. Very easy to use and super clear.

The disadvantages

The disadvantages are that if you want to do more complex things with crypto, such as staking and lending, it is better to choose another broker. The other disadvantage is that the range of ETFs is not very large. So if you have a portfolio that is a bit more complicated or need fairly specific ETFs, there is a good chance that you will not be able to achieve them. We also use different brokers for different purposes. If you are still looking for a broker or want to see other recommendations, you can see them below.

Conclusion

If we learn from history, we will see many changes, and new parties will enter the market that will dominate the crypto market. Because we cannot predict in advance which crypto coins are a good or bad investment, it is best to follow the entire cryptocurrency market. The easiest way to invest in crypto is to use index investing. This way you can grow your wealth passively without having to waste time following crypto news or looking for the best crypto coins. Crypto prices, just like stock prices, cannot be predicted.

Based on our conditions, we settled on the BitPanda crypto indices. There, they can choose from 3 different indices, one of which is invested in the top 25 crypto coins. With this index, you can buy the top 5, top 10, or top 25 cryptocurrencies based on market size and liquidity with a transaction starting from €10. The index automatically adjusts the weighting of your portfolio over time. This way you get nice average returns from the crypto market and automatically invest in tomorrow’s winners.

If there are or are better alternatives, I will certainly investigate them, so if I have overlooked something or if you have a better alternative, I would like to hear about it.